EnFi Portfolio Monitoring & Risk Analysis

Transforming Financial Risk Management Through Intelligent Design

Overview

My role: Product Designer

Timeline: 10 months (Discovery to MVP Launch)

Team: Cross-functional team of 8 (Product, Engineering, Data Science, Financial Analytics, Compliance)

Focus Areas: FinTech UX, Data Visualization, Workflow Automation, Risk Assessment Interface Design

The Problem

Manual Portfolio Management Creating Critical Business Risks

Financial institutions and investment firms faced significant operational inefficiencies in loan portfolio monitoring and risk assessment that were impacting decision-making speed and accuracy:

The Scale of the Challenge:

Days of manual work required for annual portfolio reviews

Multiple disconnected systems for financial data, covenant monitoring, and risk analysis

Inconsistent documentation quality across loan assessments

Delayed risk identification due to manual monitoring processes

High operational costs from redundant data entry and analysis

Core Problems Identified:

Data fragmentation: Critical financial information scattered across multiple platforms and document formats

Manual covenant tracking: Risk of missing critical compliance deadlines and covenant breaches

Inconsistent risk assessment: Lack of standardized evaluation criteria across portfolio

Report generation bottleneck: Lengthy manual process for creating investment memos and credit documentation

Limited predictive insights: Reactive rather than proactive risk management approach

"We were spending more time gathering data than actually analyzing risk. By the time we identified problems, it was often too late to take preventive action." - Senior Portfolio Manager

Research & Discovery Process

Understanding the Financial Ecosystem

Research Methodologies Employed:

1. Financial Workflow Ethnography (4 weeks)

Conducted 18 in-depth interviews with portfolio managers, risk analysts, and compliance officers

Mapped current-state workflows across loan origination, monitoring, and review processes

Identified 23 key pain points and 12 critical decision moments

Documented regulatory compliance requirements and audit trail needs

2. Competitive Analysis & Market Research (2 weeks)

Evaluated 12 existing portfolio management and risk assessment platforms

Analyzed regulatory requirements across different financial institutions

Assessed integration capabilities with existing financial systems

Benchmarked data visualization standards in financial services

3. Data Flow Analysis & Technical Constraints (2 weeks)

Mapped data sources and formats across financial institutions

Collaborated with engineering to assess real-time data processing capabilities

Defined security and compliance requirements for financial data handling

Established scalability parameters for enterprise-level deployment

Findings

Users accessed 8+ different systems daily

Impact: High

Design Implications: Unified dashboard priority

65% of time spent on data collection vs. analysis

Impact: High

Design Implications: Automated data extraction essential

Covenant tracking errors occurred 15% of the time

Impact: Critical

Design Implications: Real-time monitoring with alerts

Report generation took 2-3 days per loan

Impact: Medium

Design Implications: Template-based automated reporting

Cross-Functional Collaboration

Building Trust in Financial Technology

Design ↔ Data Science Partnership:

Design ↔ Financial Analytics Partnership:

Weekly risk modeling sessions to understand predictive indicators and scoring methodologies

Co-created financial dashboard patterns that analysts could interpret quickly

Established data accuracy validation protocols for automated insights

Design ↔ Compliance Integration:

Bi-weekly regulatory reviews with compliance officers

Audit trail design ensuring all user actions and data changes were tracked

Security-first interface design meeting financial industry standards

Design ↔ Engineering Collaboration:

Daily integration standups during data pipeline development

Real-time data visualization optimization for large portfolio datasets

Performance testing for enterprise-scale financial data processing

Stakeholder Management:

Monthly executive demos showcasing ROI potential and risk reduction

User acceptance testing with actual portfolio managers using live data

Change management planning for organizational adoption across financial teams

The Solution: Intelligent Portfolio Intelligence Platform

Core Features Designed:

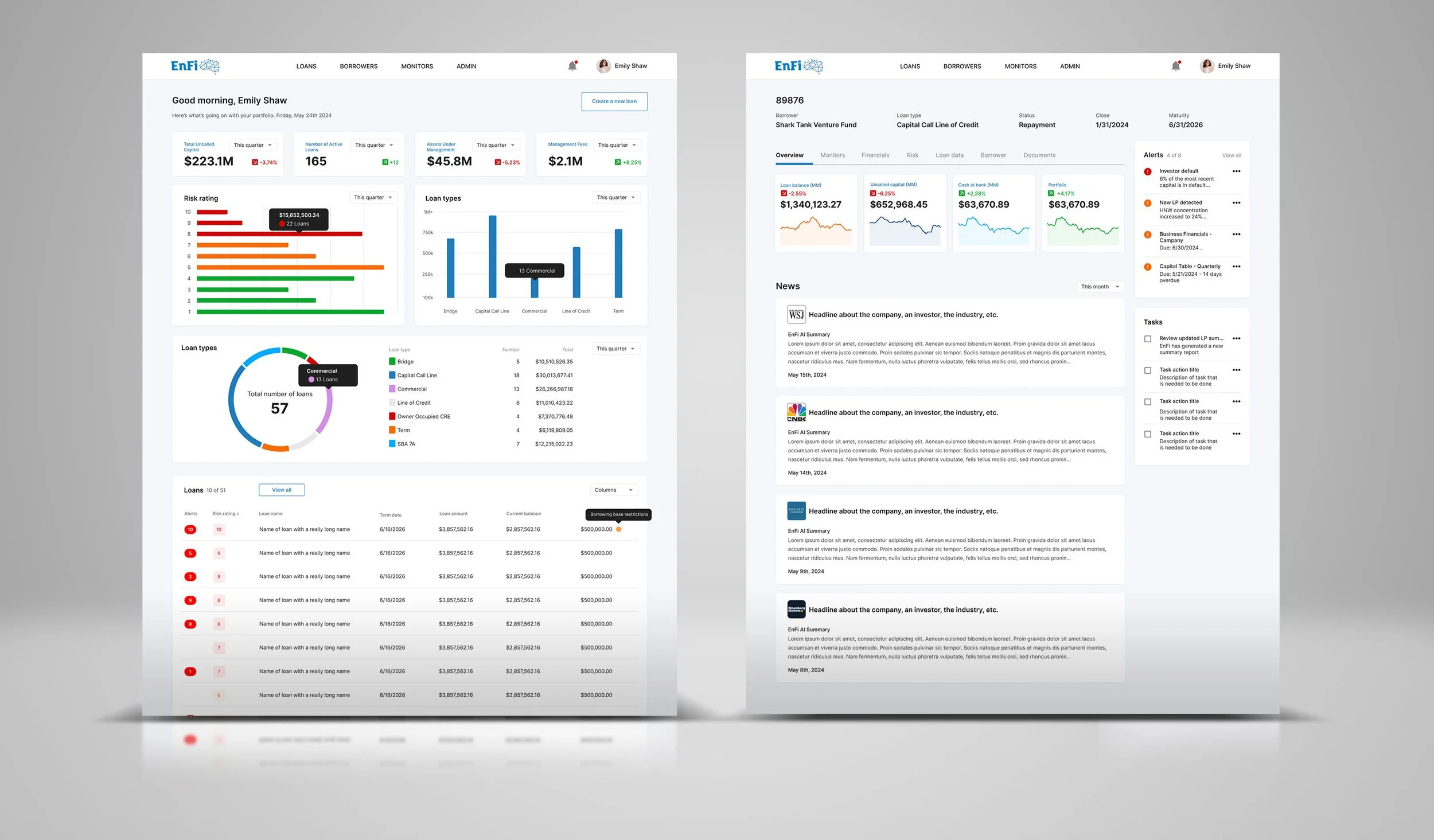

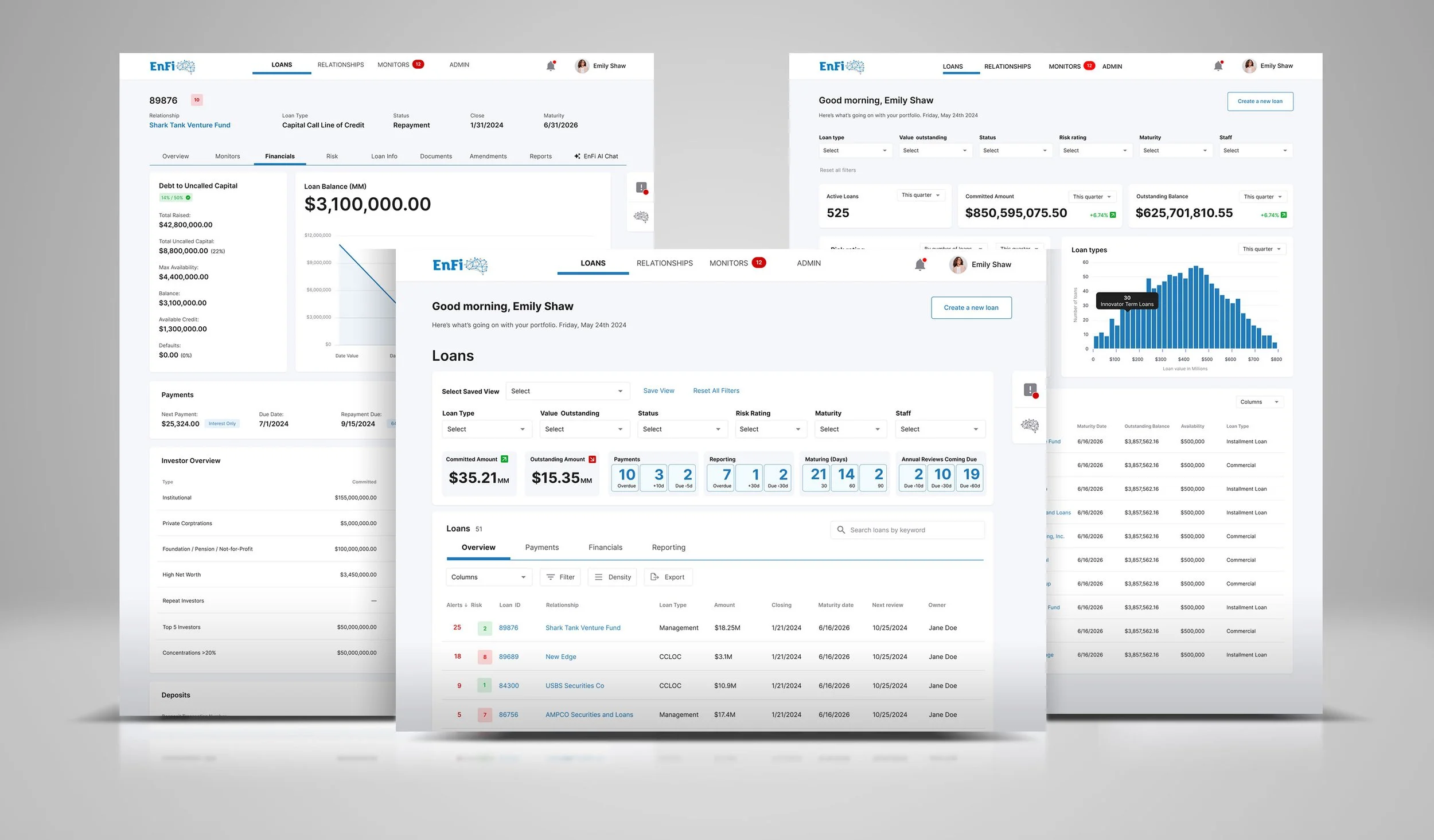

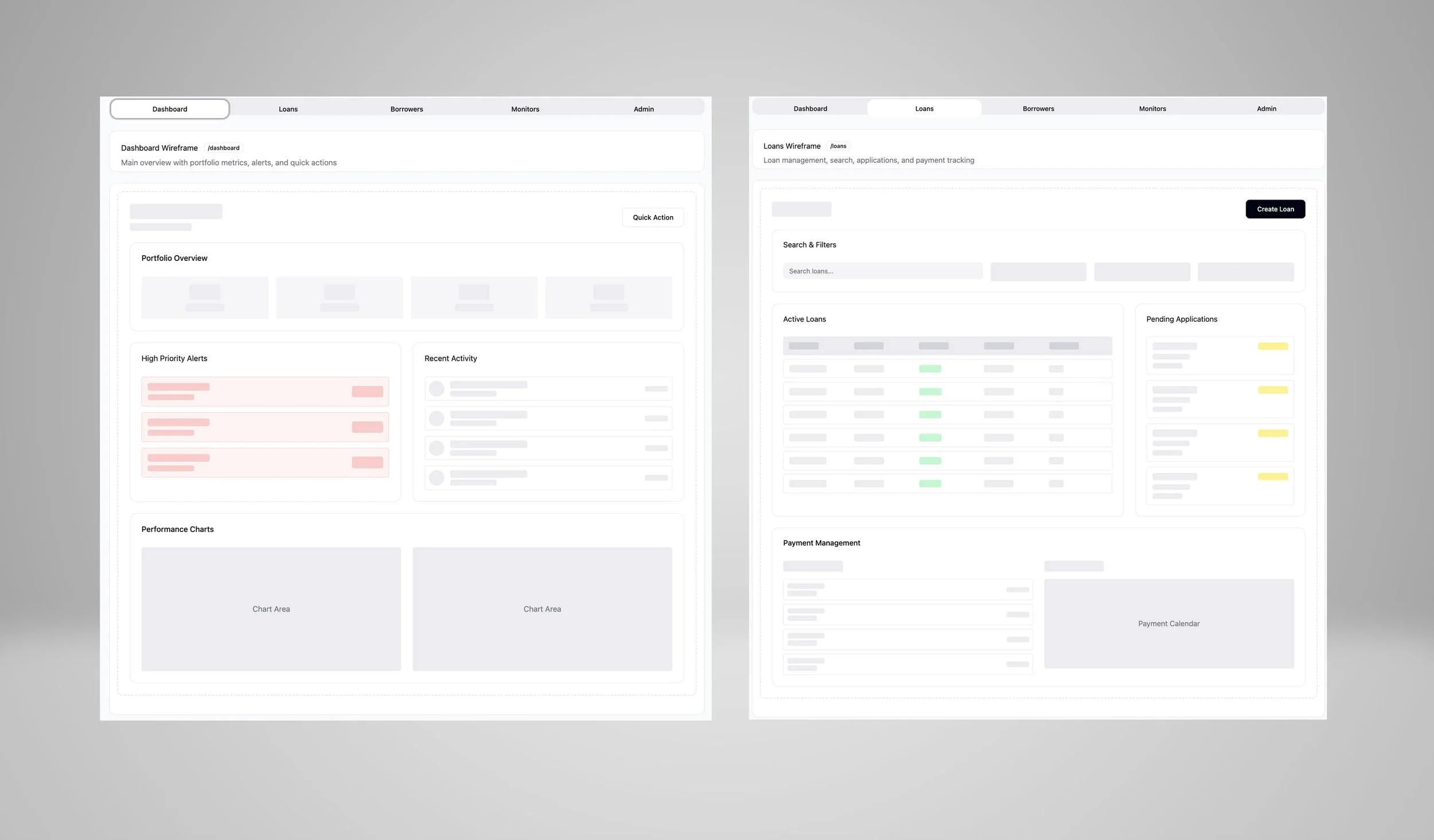

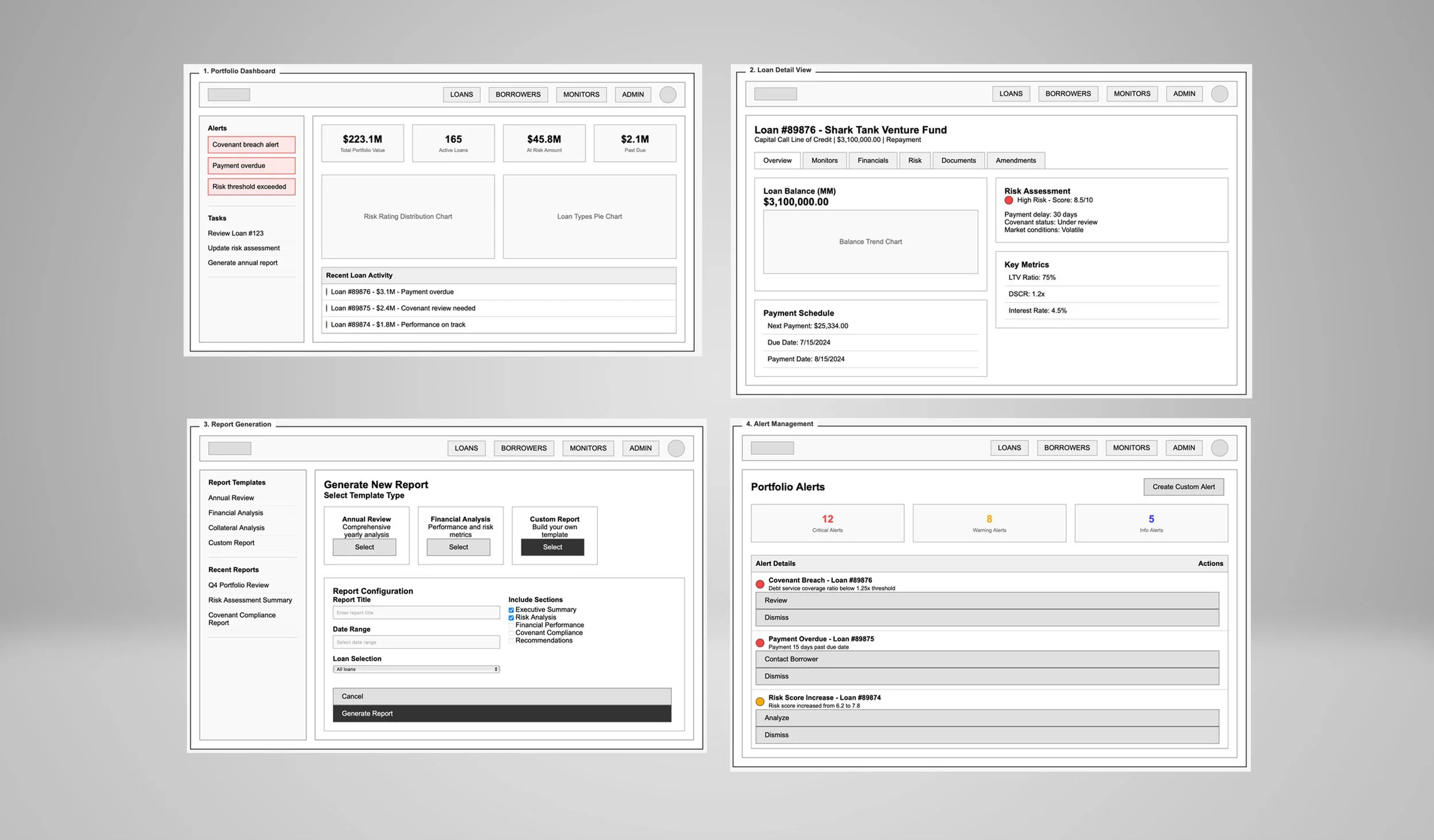

1. Unified Portfolio Dashboard

Real-time portfolio overview displaying total loan values, risk ratings, and performance metrics

Interactive risk rating visualization with color-coded severity indicators (10-point scale)

Loan type distribution analysis with donut charts showing portfolio composition

Performance trend tracking with historical and predictive analytics

Task management integration with automated workflow assignments

2. Comprehensive Loan Management System

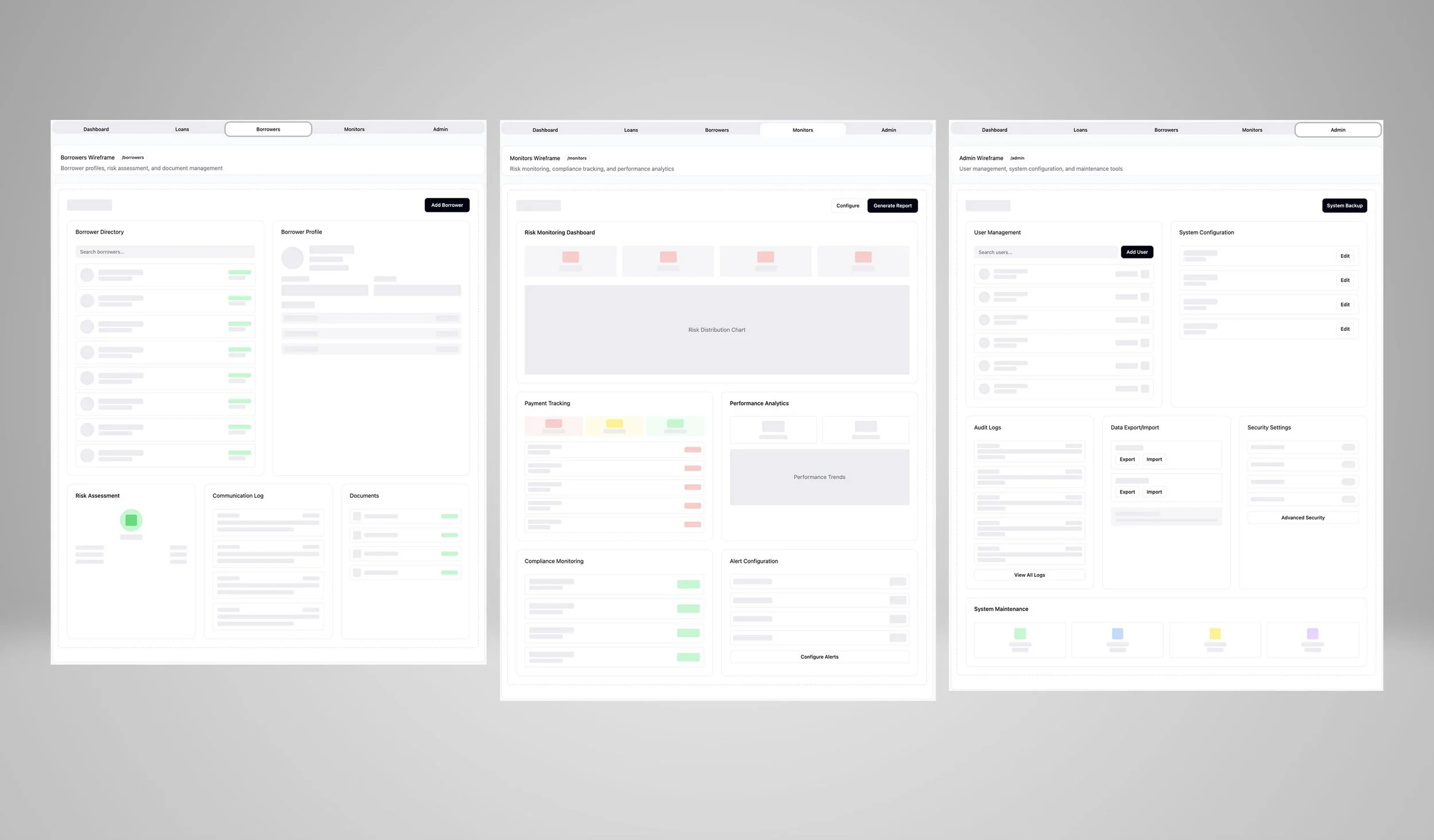

Detailed loan profiles with complete financial histories and covenant tracking

Multi-tab organization (Overview, Monitors, Financials, Risk, Documents, Amendments)

Real-time payment tracking with automated status updates

Covenant compliance monitoring with proactive breach alerting

Document management with version control and audit trails

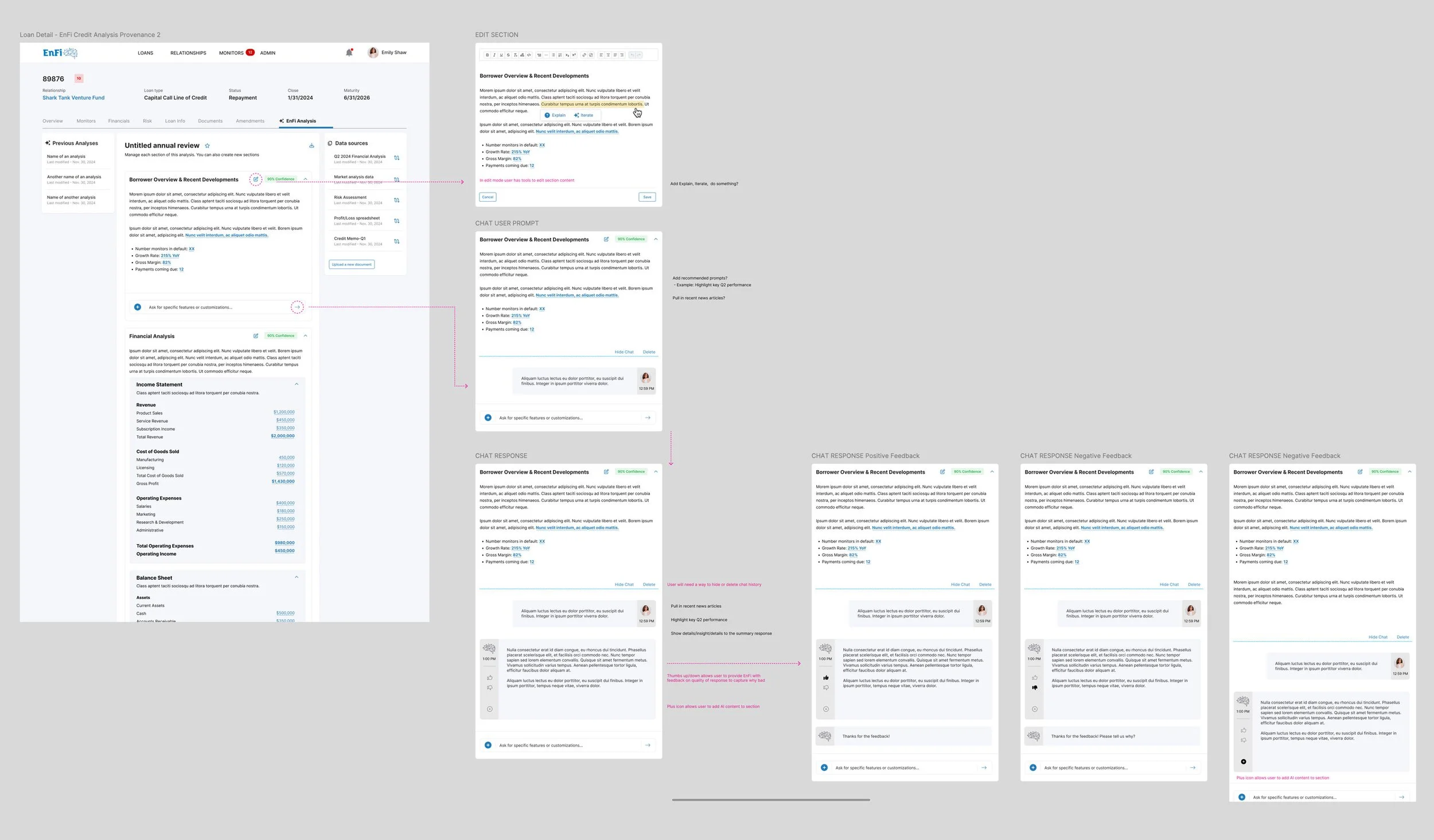

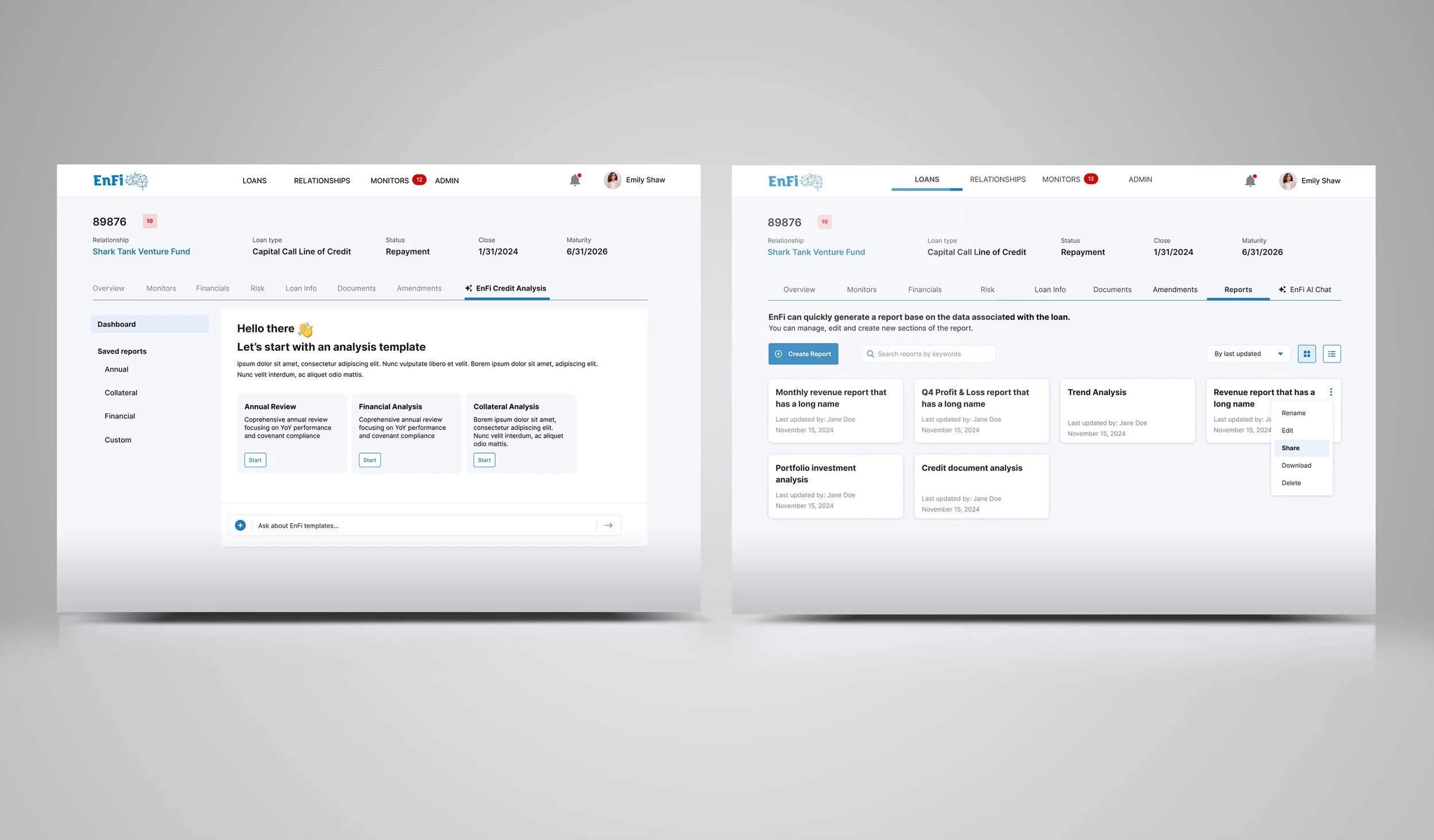

3. Advanced Analytics & Reporting

Template-based report generation for annual reviews, credit memos, and investment documentation

Customizable analytics templates (Annual, Collateral, Financial, Custom reports)

AI-powered narrative generation with editable insights and recommendations

Export capabilities in multiple formats for downstream analysis and presentations

4. Risk Assessment & Monitoring

Automated risk scoring based on financial performance and market indicators

Covenant tracking dashboard with real-time compliance status

Predictive analytics for identifying potential portfolio risks

Alert management system for critical events and threshold breaches

5. Data Integration & Processing

Multi-format document ingestion with automated data extraction

Financial data normalization across different document types and formats

Real-time data synchronization with external financial systems

Audit trail maintenance for regulatory compliance and reporting

Key Design Decisions

Decision 1: Unified Dashboard Approach

Rationale: Users were accessing 8+ different systems daily, creating inefficiency and error risk

Implementation: Comprehensive portfolio overview with drill-down capabilities to detailed loan information

Impact: 60% reduction in system switching time, 40% faster daily portfolio reviews

Decision 2: Real-Time Covenant Monitoring

Rationale: 15% covenant tracking error rate was creating significant compliance risks

Implementation: Automated monitoring with proactive alerts and visual status indicators

Impact: 95% reduction in covenant compliance oversights, 70% faster breach response time

Decision 3: Template-Based Report Generation

Rationale: Report creation took 2-3 days per loan, limiting analysis capacity

Implementation: AI-powered templates with customizable narratives and automated data population

Impact: 80% reduction in report generation time, consistent documentation quality

Decision 4: Progressive Disclosure Interface

Rationale: Financial data complexity required both overview and detailed analysis capabilities

Implementation: Hierarchical information architecture with contextual navigation

Impact: 45% improvement in user task completion rates, reduced cognitive load

EnFi portfolio dashboard and loan detail page

AI prompt interaction

Creating reports

EnFi landing page concepts

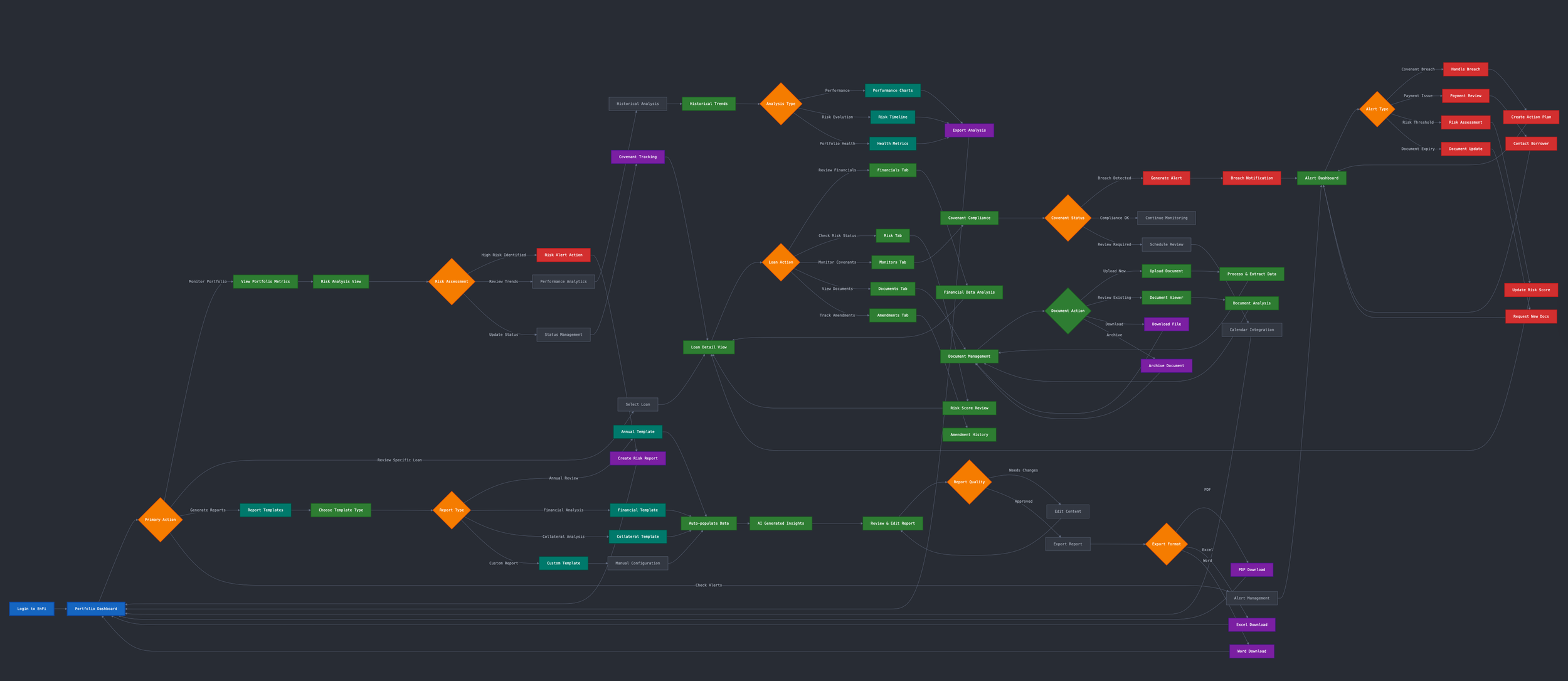

User flow diagram

Wireframe sketches

Wireframe sketches

Wireframe sketches

Wireframe sketches